Claritech Lab – The Second Income Experiment – Update as of 7th September 2025 (Month 4)

- Ranjeet M CFTe

- Sep 7, 2025

- 3 min read

Welcome back to The Second Income Experiment by Claritech Labs. This update covers the period 12th May 2025 to 5th September 2025.

Account Performance

The account has continued to build on earlier gains and has now reached an Ending VAMI of 1,532.88. That translates to more than a 50% increase from inception in mid-May. Over this period, the mean daily return has been 0.54%, with 63.5% of trading periods positive.

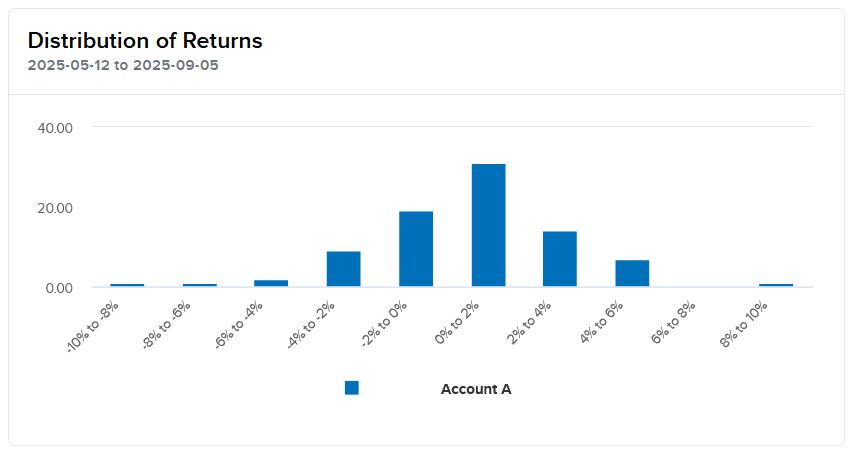

The distribution of returns reflects a healthy clustering between 0% to +2%, with relatively few periods of large drawdowns. Risk-adjusted performance remains robust, highlighted by a Sharpe Ratio of 3.21 and a Sortino Ratio of 5.10.

That said, the journey has not been without volatility:

The maximum drawdown was 15.6% (from 28th July to 15th August).

Encouragingly, the account recovered in just 11 days, reflecting both disciplined risk management and the importance of not capitulating during stressful periods.

Market Backdrop

The last four weeks in US markets have been marked by swings between optimism and caution, with investor focus firmly on inflation, Fed policy, and sector rotation:

Week ending Aug 15: Equities advanced on cooler CPI data and resilient earnings, with small- and mid-cap stocks leading the way. Investors rotated into cyclicals like homebuilders and health care, while mega-cap tech lagged slightly

Week ending Aug 22: Risk appetite extended, with small-caps and cyclicals again outperforming. Fed Chair Powell’s Jackson Hole comments suggested flexibility on policy, supporting the rally, though mega-cap tech remained under pressure

Week ending Aug 29: The S&P 500 and Nasdaq reached new highs midweek before giving back ground on Friday amid profit-taking. Semiconductor stocks, which had wavered after mixed earnings, dragged into the holiday weekend, while macro data (GDP, PCE) kept September rate-cut odds steady

Week ending Sep 5: Markets posted modest gains, with the Nasdaq leading thanks to mega-cap tech strength. Softer labor data cemented expectations of a September rate cut, while smaller-cap indices outperformed, confirming broader participation beyond large caps

Top Contributors

The portfolio’s gains have been driven by a mix of index futures, selective stock positions, and options strategies:

Futures: Trading on DAX contracts remains the largest contributor, with realized gains of £2,425 and additional open positions carried forward.

Options: Exposure to NVIDIA puts and DAX calls added over £300 in realized P&L, offering tactical diversification.

Stocks:

Vodafone (+16.8%) and RWS Holdings (+13.8%) have been solid contributors, together adding close to £975.

ModivCare (+135.6%) delivered strong upside, with realized gains of £334.

JD.com (-1.9%) has been a mild drag so far, while Glencore and OceanPal have been relatively flat.

This blend of tactical futures trading and selective stock picking has provided resilience, ensuring the account continues to advance despite broader market swings.

Takeaway

This experiment began with a simple question: can trading provide a second income if approached with patience and discipline? Nearly four months in, the results are encouraging, but the emphasis remains on consistency rather than chasing outsized gains. The statistics so far suggest that controlled risk-taking and timely recovery from drawdowns are more important than avoiding losses altogether.

The journey continues.

Disclaimers: The content of this blog is provided for informational and educational purposes only. It does not constitute investment advice, trading advice, or a recommendation of any kind. Always consult with a qualified financial advisor before making any trading or investment decision.

Comments